About death benefits

The level of death benefits payable will be different depending upon whether you were employed or you had left the employment of the Company, at the time of your death.

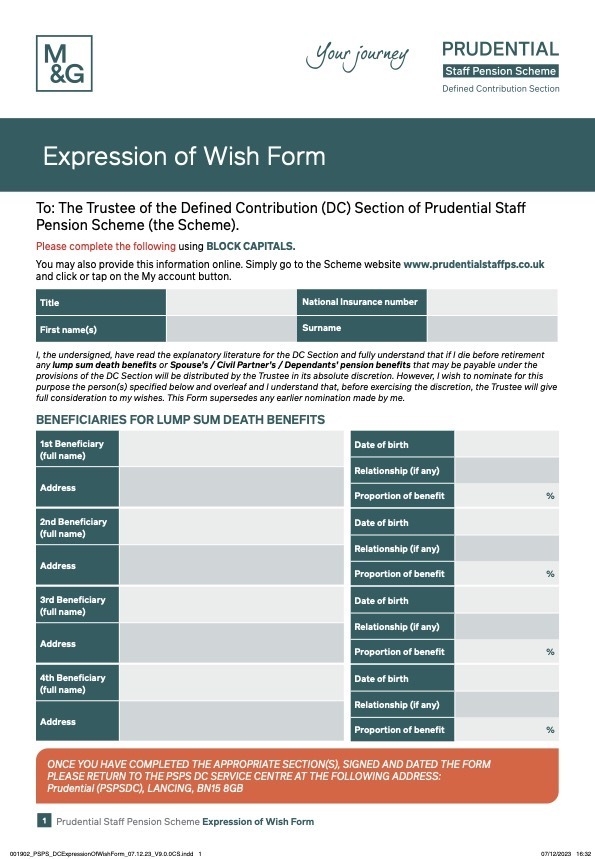

It’s really important that you have completed, and then regularly update your Expression of Wish. It’ll help the Trustee to decide who should receive any benefits payable from the Scheme if you die. What’s more, certain potential recipients, for example partners, can only be considered to receive these benefits if you have nominated them using an Expression of Wish.

The quickest and easiest way to update your Expression of Wish is online, via your Personal Account at MyPru. Alternatively, you can download and complete an Expression of Wish Form.

Expression of Wish Form

Let the Trustee know who should receive benefits if you die.

Death in Service benefits

Unless certain restrictions apply if you die while you are employed and a member of the DC Section, the following benefits could be payable:

- A lump sum payment of four times your Pensionable Pay

- A lump sum payment of the value of your Personal Account which relates to your personal contributions or Pensions Plus contributions (Employer Credits and Matching Employer Credits are not refundable); and

- A pension for your Spouse, Civil Partner/same sex spouse or Dependant(s).

If you joined the DC Section after taking flexible retirement from one of the Company’s defined benefit schemes your death in Service benefits are different from those quoted above.

Death before retirement but having left the DC Section

If you should die, whilst you are a Deferred member, a lump sum death benefit equal to the value of your Personal Account will become payable.

What benefits are payable if I should die after opting out?

If you have opted out or have elected to be treated as having never joined the DC Section, you will still be entitled to some death in Service benefits unless you have elected not to be treated as a death benefit member. In the event of death while in employment, a lump sum death benefit of four times your Pensionable Pay will become payable, plus a return of the value of your Personal Account (if any).

Death in retirement

The benefits payable on your death (including whether a Spouse's, Civil Partner's or Dependent's pension is payable) will depend upon the choices you made when you retired.